1pile All Necessary information And you will Documentation

There’s a lot from documentation doing work in applying for a great financial for the Canada. The greater amount of wishing you are, the convenient and you can shorter your sense will be. When you’re specific mortgage lenders may require various other advice and papers, all the consumers should have the following readily available whenever applying for a home loan:

- Page out-of a position

- Tax statements on past 12 months (possibly 3 years when you find yourself notice-employed)

- Lender statements (normally step three months’ really worth)

- Photocopy out of government-granted I.D.

- Way to obtain deposit

2. Look for A home loan company

When searching for a lending company, a mortgage broker can be helpful. Might shop around to own a lender on your behalf dependent in your financial and you will borrowing from the bank profile. They will certainly make it easier to receive pre-recognition with multiple lenders which help loans in Cotopaxi, CO the thing is a mortgage that have mortgage and you can title that actually works good for you. This will save you day, work, and money.

3. Implement On the internet

Once you have chosen a lender, complete the necessary guidance records on it. They are going to take a look at your revenue, debt-income proportion, possessions, and you can credit history. In just a few days, you should found your computed mortgage approval limitation and interest.

cuatro. Begin Household Hunting

Together with your pre-acceptance, you can begin searching for home affordable. Think about, you don’t need to spend all of your pre-acceptance count. It is demanded to adopt home prices one slide well lower than the pre-accepted restriction to cease to-be household-bad.

5. Get Home loan Recognized

After you’ve found the house we want to pick plus bring could have been accepted, you are able to alert their lender to start brand new underwriting techniques. Through to verification, your own financial will send you the certified commitment, which is a file filled with their interest rate, financial identity, or other associated pieces of guidance.

6. Signal Formal Data files And you can Personal The deal

The state closure day occurs when the fresh new disbursement of your own financial takes place. This means all the events will have the required funds from your own mortgage lender.

You’ll also signal the borrowed funds records, also work and you will money verification, verification regarding downpayment, first financials, and you can assets details. Later, the mortgage agent have a tendency to get in touch with the financial institution so you’re able to transfer finance so you can the fresh attorneys. On top of that, the latest attorney have a tendency to distributed the money for the sellers’ agencies.

On the whole, the procedure may take a few days, as mentioned. Yet not, in the event the there are people hiccups in the process, this may drag out in order to two weeks.

Just what Not to Create Whenever Waiting for A home loan Approval

While you’re waiting around for finally loan recognition, there are some things you shouldn’t do to stop postponing the procedure if you don’t providing refused a home loan completely:

Try not to Changes Operate

The pre-recognition will be based upon your a job and you can money. If the things here change, it might toss an effective wrench about financial recognition techniques.

When your money dips, you will possibly not have the ability to be eligible for normally out of financing. Similarly, whether your a job position transform, this may adversely apply at your task stability so far as their financial is worried.

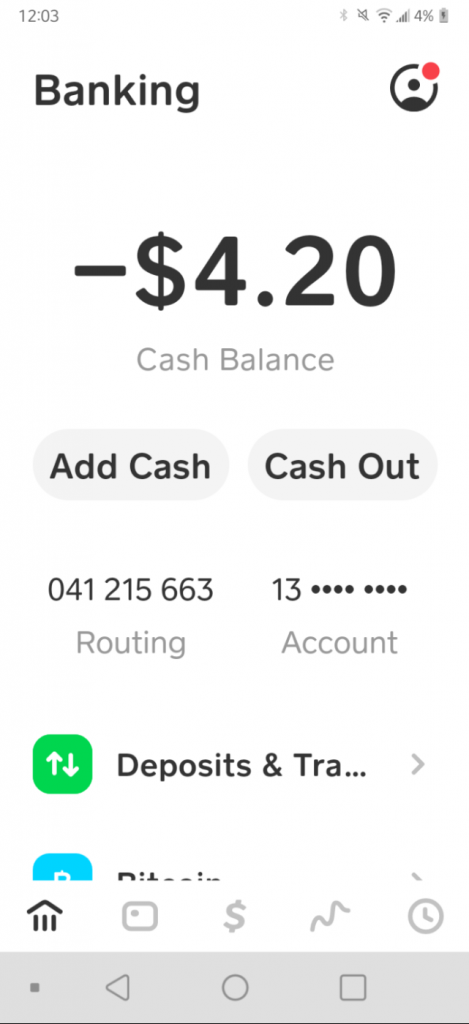

You should never Increase the amount of Debt

If you are taking aside an auto loan, apply for so much more credit cards, otherwise apply for a consumer loan, this will every add to the debt while increasing your debt-to-money proportion. Incorporating far more financial obligation to your heap usually throw-off their home loan approval because your financial try basing its decision partially to the loans you’re already spending.

Applying for a lot of the latest credit issues also can adversely impact your credit score. When your get dips, possible lower your chances of providing recognized for a home loan.