So it pro book tend to outline how a home collateral financing really works getting home improvement funding, together with bring specialist information in the act!

Because the a homeowner, you will be offered a house security mortgage as an easy way to help you secure a house recovery mortgage? or make use of your residence guarantee.

Trying to find a perfect money provider for your house remodeling venture is feel just like building an elaborate mystery. Happy to you, amidst that it detailed puzzle, enjoys came up a standout solution: the house equity financing-specifically, New RenoFi Domestic Equity Financing, a house improvement financing? game-changer.

W?e’ll respond to all your valuable concerns contained in this professional book making yes your? see the particulars of a property equity mortgage just before you use.

What is actually a property Equity Mortgage

A property guarantee loan, called the next home loan, makes you borrow secured on the newest security of your house.

However,, before you could truly know very well what property collateral loan are, you should basic know how home security work.

Domestic security refers to the part of a property’s worth one the fresh new resident truly is the owner of, calculated by deducting this new a great home loan equilibrium on the current market value of the property. They means the fresh new accumulated monetary stake this new citizen has built within the their property throughout the years.

Example: Can you imagine you possess property that have market worth of $3 hundred,000, plus a fantastic mortgage balance are $200,000.

Your property collateral will be $100,000 ($300,000 – $2 hundred,000). So it number is a secured item that one can possibly availability owing to a home guarantee financing otherwise line of credit, to have aim eg renovations.

House collateral develops since you generate mortgage payments plus the property’s well worth appreciates, giving you an important money to have reaching your financial requirements because of the way of a house equity financing and you will HELOCs.

H?ome Security Financing Professional Tip: Lenders tend to determine the house’s value to determine your credit potential. Committing to home improvements doesn’t only improve your liveable space as well as improve residence’s security. Keep track of industry trend and concentrate to your plans that provide a knowledgeable return on investment to increase your home equity and you will mortgage alternatives.

A beneficial RenoFi Mortgage are a new form of home restoration service that payday loans online New Jersey provide family collateral fund (and HELOCs) you to definitely merge a knowledgeable items of a houses mortgage for the convenience of a property guarantee mortgage, whilst the allowing you to use during the lowest you are able to rate of interest and steer clear of the need to refinance.

RenoFi Fund enables you to acquire considering exactly what your residence’s worthy of would-be after your recovery is done. Essentially, you may be experiencing you to definitely rise in guarantee now and you will borrowing alot more in the a decreased fixed rate of interest.

Home Guarantee Mortgage Eligibility & Requirements

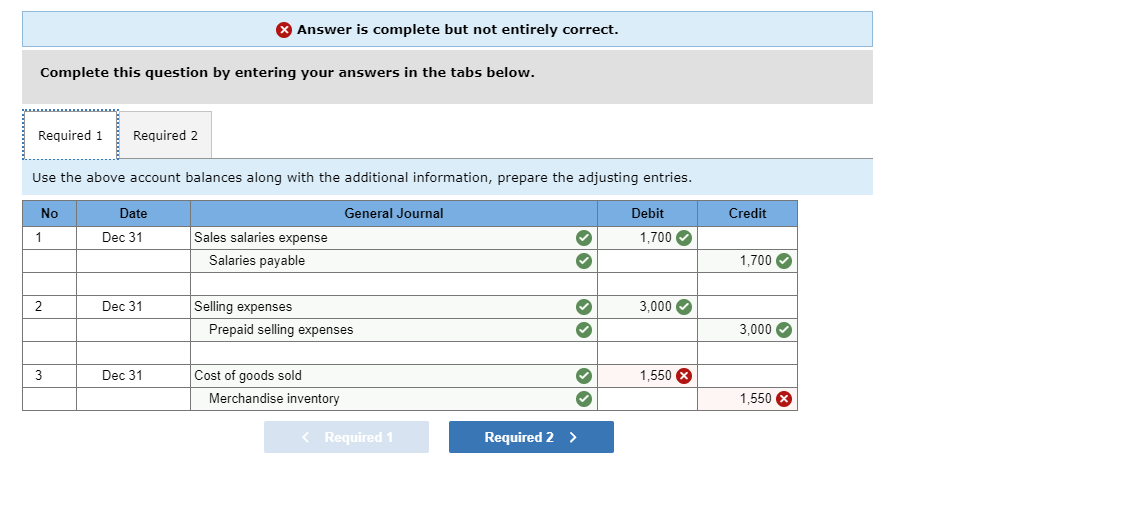

Locate a house collateral financing, attempt to experience an application procedure that is just like the processes to get a vintage financial. Full required from 14 days so you’re able to 2 months to get a home collateral financing. To help you qualify for property security financing, make an effort to satisfy particular qualifications conditions, eg that have a good credit score and you can financing-to-worth ratio contained in this acceptable restrictions.

One of several key factors getting qualifying for a house equity financing, a vital you’re keeping a stronger credit rating, basically over 700. A common error consumers build are underestimating the necessity of its credit rating regarding recognition techniques. A powerful credit rating not just advances your chances of qualifying in addition to helps secure more positive rates, potentially saving you many across the life of the loan. states Tom Yoswa, Sr. Loan Advisor from the RenoFi.