This isn’t just for large corporations; even small companies, like ones that handle small company payroll services, use capital budgeting. The decision to invest money in capital expenditures may not only be impacted by internal company objectives, but also by external factors. In 2016, Great Britain voted to leave the European Union (EU) (termed “Brexit”), which separates their trade interests and single-market economy from other participating European nations. Payback periods are typically used when liquidity presents a major concern. If a company only has a limited amount of funds, it might be able to only undertake one major project at a time. Therefore, management will heavily focus on recovering their initial investment in order to undertake subsequent projects.

Internal Rate of Return

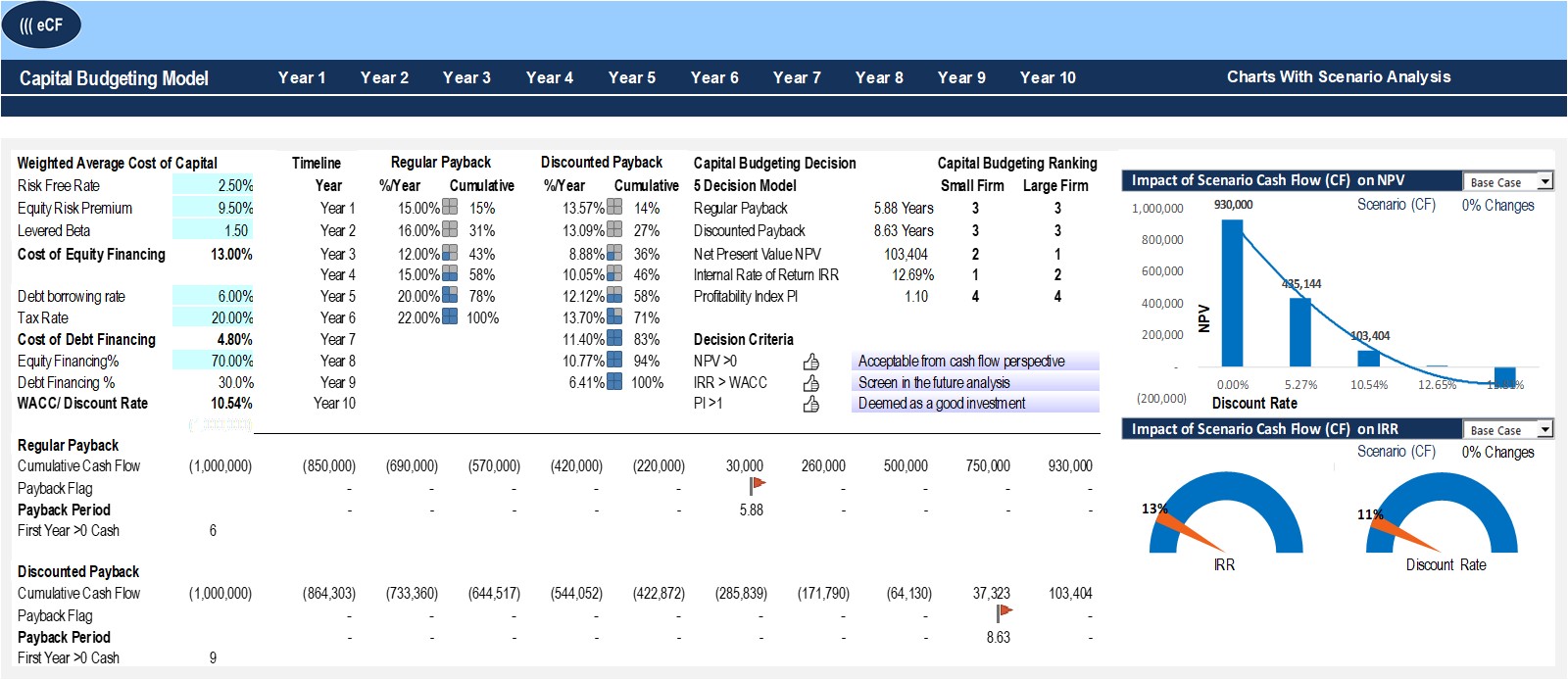

It provides a better valuation alternative to the payback method, yet falls short on several key requirements. There is no single method of capital budgeting; in fact, companies may find it helpful to prepare a single capital budget using the variety of methods discussed below. This way, the company can identify gaps in one analysis or consider implications across methods that it would not have otherwise thought about. A bottleneck is the resource in the system that requires the longest time in operations. This means that managers should always place a higher priority on capital budgeting projects that will increase throughput or flow passing through the bottleneck.

Practice Video Problem 11-2: Net present value method LO6

This machine would cost $1 million to purchase and install, but it is expected to save the company $200,000 per year in labor costs. This software can significantly improve decision-making by providing a comprehensive view of financial data. Since a capital budget can span many quarters or even many years, organizations can use DCF to not just asses the timing of cash flow but also the implications of the dollar. If you spend all of your capital investing in a new project, you’re unlikely to see the end of it. Companies need to maintain liquidity, whether for daily operations or for unexpected expenses. Capital budgeting ensures the business has sufficient cash to keep things running.

Ask a Financial Professional Any Question

She would like to purchase a new machine capable of creating custom steel tools. The formula to compute the simple rate of return is presented in Exhibit 11-3. The availability of funds obviously affects project choices, and smaller companies tend to have more capital constraints. For instance, finding suitable payroll services can be challenging if you have one employee. IRR helps businesses understand just how profitable their investment could be.

Minimizing Risk

Your printers are used daily, which is good for business but results in heavy wear on each printer. After some time, and after a few too many repairs, you consider whether it is best to continue to use the printers you have or to invest some of your money in a new set of printers. A capital investment decision what do i do if my itin number is expired like this one is not an easy one to make, but it is a common occurrence faced by companies every day. Companies will use a step-by-step process to determine their capital needs, assess their ability to invest in a capital project, and decide which capital expenditures are the best use of their resources.

- The results, however, depend on the accuracy and quality of the estimates and projection data inputted into the methods.

- Strategic capital budgeting decisions can turn the tide for a company.

- Therefore, capital budgeting refers to the process of planning projects or making decisions that have a long-term effect on the organization.

- Since the payback period does not reflect the added value of a capital budgeting decision, it is usually considered the least relevant valuation approach.

- The relative importance of this function varies with company size, the nature of the industry, and the growth rate of the firm.

- Before taking on huge investments, business owners need to consider potential upcoming changes to labor regulations and the financial implications these might have.

Capital Budget Projects

The machine will require a $50,000 general maintenance service in year 3. If they purchase this machine, they estimate that they will run 1,500 blood tests per year. At the end of the six years, the machine has a $24,000 trade-in value.

Capital budgeting’s main goal is to identify projects that produce cash flows that exceed the cost of the project for a company. As a result, payback analysis is not considered a true measure of how profitable a project is but instead provides a rough estimate of how quickly an initial investment can be recouped. Payback analysis is the simplest form of capital budgeting analysis, but it’s also the least accurate. It is still widely used because it’s quick and can give managers a «back of the envelope» understanding of the real value of a proposed project. In addition, a company might borrow money to finance a project and, as a result, must earn at least enough revenue to cover the financing costs, known as the cost of capital. Publicly traded companies might use a combination of debt—such as bonds or a bank credit facility—and equity, by issuing more shares of stock.

So before making such expenditures in the capital, the companies need to assure themselves that the spending will bring profits to the business. Investments in heavy machinery or big constructions are examples of capital budgeting. Specific project management software helps a great deal in capital budgeting and is great for reviews and the monitoring of progress. There are also investment analysis tools that can be explicitly used to gain insight into potential returns. Many teams are already harnessing the power of AI for project cost management, too.

For smaller companies, decision-makers often take on multiple financial roles. More and more companies are using capital expenditure software in budgeting analysis management. One company using this software is Solarcentury, a United Kingdom-based solar company. Read this case study on Solarcentury’s advantages to capital budgeting resulting from this software investment to learn more. Capital budgets (like all other budgets) are internal documents used for planning. These reports are not required to be disclosed to the public, and they are mainly used to support management’s strategic decision making.

There is a lot at stake with a large outlay of capital, and the long-term financial impact may be unknown due to the capital outlay decreasing or increasing over time. To help reduce the risk involved in capital investment, a process is required to thoughtfully select the best opportunity for the company. Assume that you own a small printing store that provides custom printing applications for general business use.

Payback analysis calculates how long it will take to recoup the costs of an investment. The payback period is identified by dividing the initial investment in the project by the average yearly cash inflow that the project will generate. Capital budgeting is a process that businesses use to evaluate potential major projects or investments.