This excludes any financing-related items, such as short-term debt and marketable securities. Assets that are held for trading purposes are recorded on the balance sheet at their fair value. Trading assets are bought and held primarily for the purpose of selling in the near term to generate profits on short-term price differences. The fair value of held-for-trading assets is determined using active market prices, if available.

- Examples of non-marketable securities are Government Account Series (GAS) securities — unique debt-based funding mechanisms that the U.S. government uses to cover budget deficits.

- Conversely, the return on investment for bonds purchased at a premium is lower than the coupon rate.

- PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

- Marketable securities sit in the sweet spot between the safety of cash and the return potential of longer-term investments.

What Is the Current Ratio?

Under this predominant definition, marketable securities are also called short-term investments. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision.

Marketable Securities in Accounting

This tells us that cash is number one, but right below that are the marketable securities. Commercial paper and money markets are securities corporations hold to provide highly liquid returns. Marketable securities will have an active marketplace where they can be sold and bought.

Highly Liquid

An investor who analyzes a company may wish to study the company’s announcements carefully. These announcements make specific cash commitments, such as dividend payments, before they are declared. Suppose that a company is low on cash and has all its balance tied fixed cost: what it is and how its used in business up in marketable securities. Then, an investor may exclude the cash commitments that management announced from its marketable securities. That portion of marketable securities is earmarked and spent on something other than paying off current liabilities.

Types of marketable securities

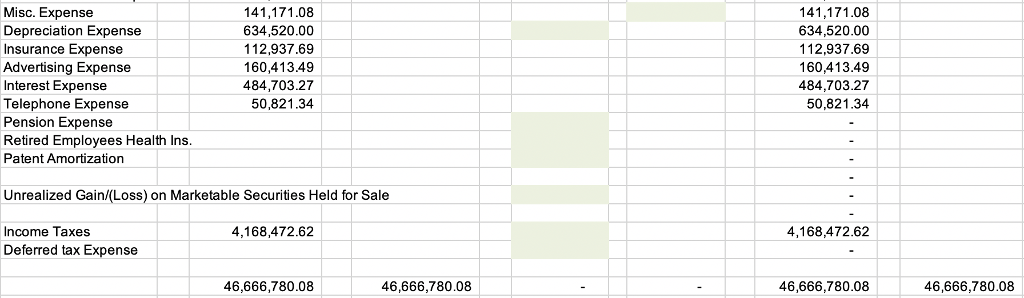

Therefore, we will add an equity account, Accumulated Other Comprehensive Income, to hold the cumulative effects of unrealized holding gains and losses on these debt securities. (Look at the equity section of the balance sheet of your favorite publicly traded company, and you will almost surely see Accumulated Other Comprehensive Income there. Marketable securities can be quickly and easily converted into cash, making them a highly liquid investment. This can be especially important for investors who need access to their funds in the short term but don’t want to lose purchasing power by simply holding onto cash. An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities.

Exchange-Traded Funds (ETFs)

High liquidity refers to the ability to resell the asset with there being many buyers available to purchase, thus reducing the amount of time to convert the assets into cash. There are liquid assets that are not marketable securities, and there are marketable securities that are not liquid assets. For example, a recently minted American Eagle Gold Coin is a liquid asset, but it is not a marketable security. On the other hand, a hedge fund may be a marketable security without being a liquid asset. Every marketable security must still satisfy the requirements of being a financial security.

Much like a bank loan, a bond guarantees a fixed rate of return, called the coupon rate, in exchange for the use of the invested funds. One of the principal characteristics of marketable securities is that they are financial instruments that provide you the potential for financial return. For example, a preferred stock, in addition to dividends, has the potential (all investing involves risk) of increasing in market value. Another example is a Treasury bill (T-bill), which sells at a price lower than its face value and grants you the full face value upon maturity of the T-bill. Instead of holding all cash in a savings account earning diddly, the companies elect to invest in marketable securities as short-term liquid investments. Instead of the money sitting there and not earning anything, the company can earn returns on its cash.

Marketable securities are financial assets that are easily traded on public markets and can be quickly converted into cash. As such, marketable securities are typically classified as current assets on the balance sheet, alongside cash and cash equivalents, accounts receivable, and inventory. Marketable securities are assets that can be quickly liquidated into cash. This type of security is typically traded on an exchange and can include stocks, bonds, and other financial instruments.

The maturity date is the specified date at which the entity has to repay the full par value of the bond. This is because shareholders have partial ownership of the company that they have invested in. The company can therefore use shareholder investment as a form of equity capital. This can be used to fund any of the company’s operations and expansions. Within equity and debt securities, there are subsections of marketable securities.